What are the benefits of the new aged care reforms to people entering an aged care home or a Home Care Package?

19/09/2024

The Australian Government announced significant reforms for the country’s aged care sector last week aimed at improving funding and the quality of care being delivered to older Australians – so what do you need to know?

Firstly, nothing will change before the new Aged Care Act comes into being, with the expected start date to be 1 July 2025. A Senate inquiry into the bill is currently due to report on Thursday, 31 October.

What is proposed:

Home care

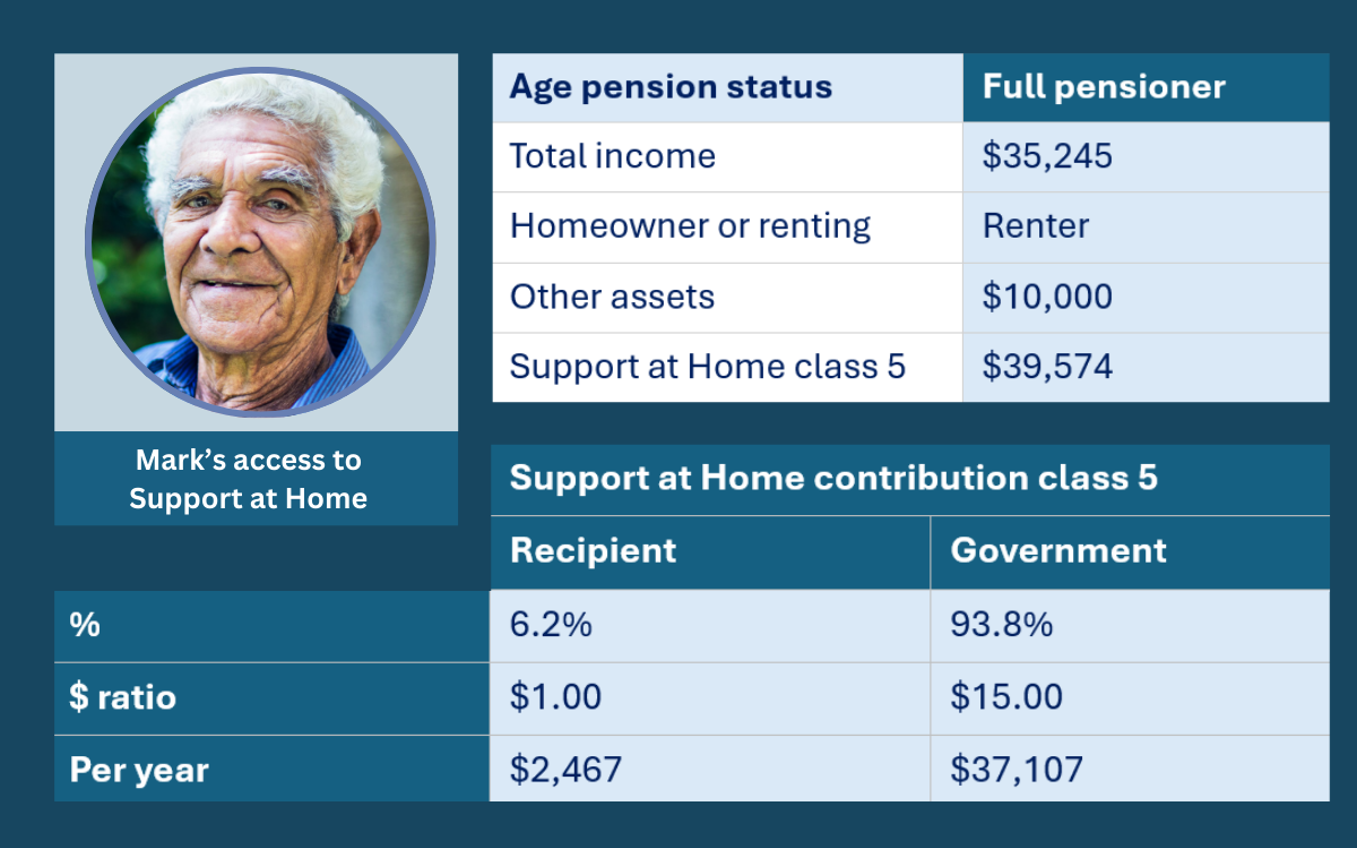

The Labor Government in a bipartisan agreement with the Opposition Coalition said when it launched the aged care bill a "no worse off principle" will apply to people who, on 12 September 2024, were either receiving a Home Care Package (HCP); in the National Priority System, or assessed as eligible for a HCP.

If the participants move into residential aged care, they will stay on the existing contribution arrangements unless they decide to move to the new program.

Proposed changes

At present, the taxpayer subsidises the cost of everyday living for all residents, regardless of their means. Everyday services include catering, cleaning and laundry.

From 1 July 2025, it is proposed that people with significant financial means (with more than $238,000 in assets, more than $95,400 in income or a combination of the two) will no longer receive this subsidy and will need to pay an additional amount to cover these costs.

People with low financial means, typically full pensioners without major assets, will be unaffected by the reforms. The Government will continue to fully cover the costs of their clinical care, non-clinical care and accommodation, and continue to top up their everyday living costs via the new hotelling supplement.

Pensioners will continue using their Age Pension to pay for their everyday living expenses, capped at 85% of the Age Pension (equivalent to $445 per week).

Those with significant means, such as self-funded retirees, will pay an additional means-tested hotelling fee to meet the full cost of their food, laundry, cleaning and utilities. This fee (up to $88 per week, or an extra $4,581 per year), would bring their total contribution to their everyday living services to $533 per week.

Self-funded retirees will contribute towards the costs of non-care services via a means-tested non-clinical care contribution. This contribution is capped at $101.16 per day (or $708 per week), which a resident would stop paying when either they reach a lifetime limit of $130,000 or four years (whichever is sooner).

Part-pensioners and self-funded retirees who pay for their accommodation via a refundable lump-sum deposit will pay a new annual deferred rental charge equal to 2% of their deposit per year.

A room priced at $550,000 would attract a rental charge of $212 per week ($11,000 per year), which would be deducted from the $550,000 deposit when it is returned to the resident or their estate at the end of their stay.

Currently, each resident’s daily payments are fixed at the price when they enter residential care. However, under the reforms, residents’ payments will be indexed twice a year.

In good news, there will be no change to the treatment of the family home Within the new means-testing arrangements at the behest of the Prime Minister Anthony Albanese.

The value of the family home included in the means test will remain capped at $206,039 (indexed).