What are the real costs of retirement living?

16/11/2023

Retirement living is attractive, with many villages at full or near-full occupancy. However, the one question we often receive about entering a retirement village is for help to understand the financial details.

There are a number of fees and costs to consider and it is helpful to break them down into three categories – the ingoing, the ongoing and the outgoing.

The Deferred Management Fee (DMF)

The DMF is normally the largest component in the outgoing category, although some villages will allow you to pay no management fee (with a higher purchase price).

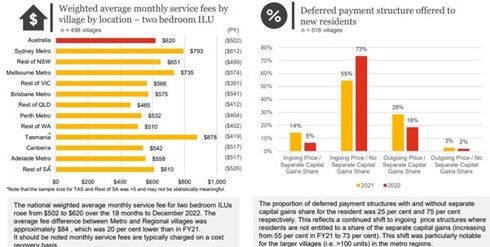

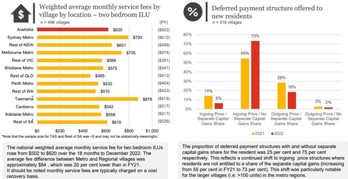

The PwC/Property Council Retirement Living Census 2022 states the most common DMF is 36%, which typically accumulates within the first six years living in the village.

Anyone thinking of entering a retirement village must ask how much the DMF is and what it is based on – the purchase or the future sale price?

If it is based on the purchase price, then you know how much it will be simply by multiplying the price by the percentage. For example, if the DMF is 6% for six years and you live in the village for 10 years, the DMF will be 36%. If your purchase price is $550,000, this means your DMF will be $198,000.

If the DMF is based on the sale price, then there is only a guesstimate of the price when a person leaves the village. Using a 2% per year growth rate would mean a $550,000 unit would have a sale price of $770,000 in 10 years’ time. If your DMF is 36% of the sale price, it would be $227,200.

Capital Gain or Loss

Allowing a resident capital gain or loss on a retirement village unit is becoming less prevalent. The latest Census stated the proportion of homes without capital gains in 75%. If it does, add a conservative assessment of capital gain to your calculation.

If a person receives some (or all) of the capital gain then they may need to meet costs associated with achieving that gain, which often means renovations. If a person or persons lived in the village for 10 years, then the renovations could include a new kitchen, bathrooms and floor coverings.

Increasingly, contracts state there is no need to renovate but to reinstate the home which often involves some minor work like repairing any damage and removing any alterations made.

The contract will also state that the home may need to be advertised, which can mean professional photography and furniture styling too. Like other property transactions, there can be legal fees, administration fees and sales commissions.

Buyback

The buyback period is not a cost but it could cost money (and stress) if the person’s home does not sell. State-based legislation sets out the conditions and timeframes for buybacks which vary from no buyback through to a buyback after 18 months. There are villages that offer a buyback in a shorter period – it can be as short as three months where no buyback is required.

Many retirement living businesses now offer Home Care, which again may be a cost. Find out how much Federal Government will contribute to Home Care.

Entering a retirement living village may seem complicate but, as stated above, most villages are well occupied, even full, because of the benefits of living in a like-minded community with social support and activities.

Villages are also a lot cheaper than similar accommodation in the same suburb, enabling retirees to sell the family home and use the proceeds to buy their new village home and support their lifestyle in retirement.